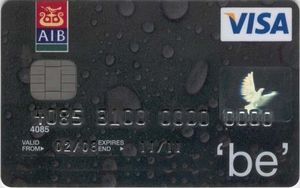

The AIB ‘be’ Visa Card is for personal customers who may need to borrow occasionally, or intend paying their outstanding balance in full every month. The 'be' Visa Card will reward customers who spend €5,000 or more in a 12 month period with a lower annual interest rate for purchases. The ‘be’ Visa is tailored for everyday customers using it for everything from buying groceries to buying petrol.

Max. 22.9 %

Assuming a credit limit on your card of €1,500, you used your full limit to make a single card purchase immediately after receiving your card, and you repaid in equal monthly payments over 12 months at an interest rate of 16.79% variable, (Representative 22.9% APR variable), the total amount you will pay back is €1636.50 which includes Government stamp duty charge of €30.00. Interest charged would be €136.50.

You must be at least 18 years old.

- Proof of Identity: a valid Passport, Driver’s Licence, EU National Identity Card

- Proof of Current Permanent Address (documents must be no more than 6 months old): Utility Bill, Correspondence from a regulated financial institution (insurance/assurance company, bank, credit card company or investment company), correspondence from a government department/body.

Fees and charges:

- Government Stamp Duty of €30 is charged annually per credit card account.

- Cash Advance Fee 1.5% of the transaction value or €1.90 whichever is greater.

- Late Payment Fee: €7.00

- Over Limit Fee: €7.00

- Returned Payment Fee: €7.00

- Copy Sales Voucher Fee: €5.00

- Copy Statement Fee: €4.00

Monday-Friday 09:00-17:00

Bankcentre, Ballsbridge, Dublin 4.

Benefits & Features

Salary Requirements

APR

Balance Transfer

Minimum age

Classic Credit Card

Representative example: Typical APR of 22.1% variable including annual Government Stamp Duty of €30. Assuming purchase of €1,500 repaid in equal instalments over a 12 month period. The total amount repayable by customer is €1661.01 which includes initial purchase of €1,500 and a total cost of credit of €161.01.

NB! Total amount payable depends on the loan amount, percentage, terms and individual creditworthiness.

Benefits & Features

Salary Requirements

APR

Balance Transfer

Minimum age

Affinity Credit Card

Representative example: Typical APR of 20.2% variable including annual Government Stamp Duty of €30. Assuming purchase of €1,500 repaid in equal instalments over a 12 month period. The total amount repayable by customer is €1,648.38 which includes initial purchase of €1,500 and a total cost of credit of €148.38.

NB! Total amount payable depends on the loan amount, percentage, terms and individual creditworthiness.

MoneyGuru SIA, Address: Rīga, Latvia, Kārļa Ulmaņa gatve 2, LV-1004

Registration number: 41503072001 Bank: Swedbank AS, E-mail: partner@moneyguru24.com

Copyright © MoneyGuru 2012-2024. All rights reserved.